BTC Price Prediction: Bulls Defend Critical $112K Support Level Amid Market Turbulence

#BTC

- Technical Outlook: MACD bullish crossover and Bollinger Band support suggest upside potential.

- News Impact: Institutional interest (Trump Media, SEC) offsets short-term FUD.

- Critical Level: Holding $112K support is pivotal for a $120K retest.

BTC Price Prediction

BTC Technical Analysis: Key Indicators to Watch

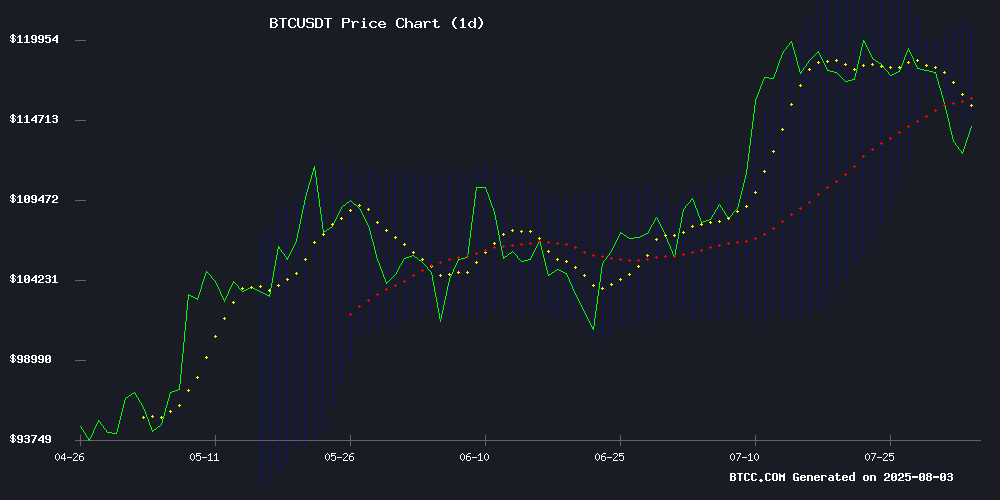

According to BTCC financial analyst Sophia, Bitcoin (BTC) is currently trading at $114,379.99, slightly below its 20-day moving average (MA) of $117,390.97. The MACD indicator shows a bullish crossover with the histogram at 1,846.7798, suggesting potential upward momentum. Bollinger Bands indicate the price is near the lower band at $113,595.36, which could act as a support level. Sophia notes that a break above the middle band at $117,390.97 may signal a bullish reversal.

Market Sentiment: Mixed Reactions to Bitcoin News

BTCC financial analyst Sophia highlights mixed market sentiment driven by recent headlines. Trump Media's $2B BTC allocation and the SEC's higher bitcoin ETF options limits could spur demand, while the disappearance of the Satoshi statue adds a quirky twist. Sophia emphasizes that despite short-term volatility, Bitcoin's dominance at a 3-year high and miners' post-halving revenue record underscore long-term bullish fundamentals.

Factors Influencing BTC’s Price

Trump Media Bitcoin Move Raises Questions Amid Speculation

Trump Media & Technology Group (TMTG), the parent company of Truth Social, faces scrutiny over unverified reports of a $2.4 billion Bitcoin investment strategy. Despite widespread speculation, no official documentation or executive statements confirm the claims. TMTG's reported $3.1 billion in total assets by June 2025 has fueled rumors of a $2 billion Bitcoin allocation, but regulatory filings and press releases remain silent.

The lack of transparency has left investors questioning whether the buzz is grounded in reality or mere conjecture. Market reactions suggest heightened interest, but without concrete evidence, the situation resembles a rumor mill rather than a strategic pivot. Bitcoin's prominence in the narrative underscores its growing influence in corporate finance, even as skepticism lingers.

Strategy’s Q2 Earnings Surge, Announces New $4.2B STRC Offering to Buy More Bitcoin

Strategy (NASDAQ: MSTR) has pivoted to profitability in its Q2 2025 earnings, reporting a net income of $10.02 billion. The dramatic turnaround stems largely from $14 billion in unrealized gains on its digital asset holdings, underscoring the success of its aggressive Bitcoin acquisition strategy initiated in 2020 by co-founder Michael Saylor.

Total revenues edged up 2.7% year-over-year to $114.5 million, while operating income skyrocketed 7,106.4% to $14.03 billion. The company now holds 628,791 BTC—nearly 3% of circulating supply—fueled by over $10 billion raised through capital programs this year. Since adopting its Bitcoin-centric approach, Strategy’s stock has surged 3,000%.

The firm plans to further amplify its crypto position with a new $4.2 billion STRC offering. "Our capital raising has increased Bitcoin per Share by 25% year-to-date," the company stated, reinforcing its conviction in digital assets as a core treasury strategy.

SEC's Higher Bitcoin ETF Options Limits May Reduce Volatility, Spur Spot Demand: NYDIG

The Securities and Exchange Commission's decision to raise position limits on Bitcoin ETF options could mark a turning point for the cryptocurrency's notorious volatility. By allowing traders to hold ten times more contracts, the SEC has paved the way for strategies like covered call selling—yield-generating maneuvers that may suppress extreme price swings. NYDIG Research suggests this shift could make Bitcoin more palatable for institutional portfolios seeking stability.

Bitcoin's volatility has already been trending downward, with Deribit's BTC Volatility Index (DVOL) plummeting from 90 to 38 over four years. Yet it remains an outlier compared to traditional assets, simultaneously attracting yield hunters and deterring risk-averse institutions. The approval of in-kind redemptions for spot Bitcoin ETFs further compounds these market dynamics.

Satoshi Nakamoto Statue Disappears in Lugano, 0.1 BTC Reward Offered

The iconic Satoshi Nakamoto statue in Lugano, Switzerland, has vanished without a trace. Installed in 2024 as part of the city's Bitcoin adoption initiative, the artwork was last seen on August 2, 2025. A reward of 0.1 BTC is now available for information leading to its recovery.

Designed by Italian artist Valentina Picozzi, the statue was a visual illusion composed of vertical stripes that formed Nakamoto's likeness when viewed from a distance. Its disappearance was first reported by user Grittoshi on X, who speculated it might have been dumped into a nearby lake. The concrete structure's removal suggests a calculated theft, though motives remain unclear.

The Satoshigallery team confirmed the statue's absence shortly after the online post. The artwork had become a symbol of Lugano's ambitions as a digital currency hub since its unveiling at the 2024 Plan B Forum.

Bitcoin Retreats Below $114K Amid TRUMP Media's $2B BTC Allocation

Bitcoin's price slid below $113,700 in early August, marking a 7% decline from July's peak of $123,300. The pullback coincides with TRUMP Media's disclosure of a $2 billion Bitcoin treasury allocation—a move fueling intense debate among institutional players about crypto's long-term viability as a corporate reserve asset.

Technical charts paint a bearish picture: A symmetrical triangle breakdown and 'Three Black Crows' formation on 4-hour frames suggest extended downside. Resistance now clusters around the 50-period SMA at $116,852, while support waits at $112,043. The RSI's feeble rebound from oversold territory at 42 signals limited bullish momentum.

Market participation remains robust with $57 billion in daily volume, reflecting heightened volatility as traders digest conflicting signals—technical weakness versus growing institutional interest exemplified by TRUMP Media's bold bet.

Vandalized, Not Vanquished: Satoshi Nakamoto Statue Fished Out of Lake Lugano

The bronze and steel statue honoring Bitcoin's pseudonymous creator, Satoshi Nakamoto, was violently torn from its base in Parco Ciani and dumped into Lake Lugano during Swiss National Day celebrations. Italian artist Valentina Picozzi's two-year labor of love—a cultural landmark for the crypto community—was recovered in fragments along the shoreline.

Initial speculation oscillates between drunken revelry and anti-crypto sentiment as the motive. Satoshigallery, the collective behind the installation, confirmed the damage was vandalism rather than theft, given the statue's mangled state still attached to its pedestal. The timing raises eyebrows, coinciding with Switzerland's patriotic festivities.

Bitcoin advocates worldwide reacted with outrage. The statue's deliberate design to blend into its surroundings—mirroring Nakamoto's own disappearance—added poetic irony to its defacement. Lugano, a burgeoning crypto hub, now grapples with restoring a symbol of decentralized ideals.

Bitcoin Miners Achieve Post-Halving Revenue Record Amid Market Adjustments

Bitcoin mining revenues surged to $1.66 billion in July 2025, marking the highest level since the 2024 halving event. The rebound reflects a 4% increase in daily earnings per exahash compared to June, yet profitability remains 43-50% below pre-halving benchmarks. Miners now navigate rising network difficulty and compressed margins—a stark contrast to the $100,700/EH/s yields seen before April 2024.

Sector adaptation continues through technical optimization and cost management, but August looms as a critical test. Upcoming difficulty adjustments and geopolitical volatility could destabilize this fragile equilibrium. The mining industry's resilience faces its next stress test as capital efficiency becomes existential.

Bitcoin Dominance Hits 3-Year High Despite August Risks

Bitcoin has reasserted its dominance in the cryptocurrency market, with its share of total market capitalization climbing to an average of 59.3% in 2025. This marks the highest level in three years, according to data from CoinGecko. The resurgence reflects strong institutional interest and the growing adoption of spot Bitcoin ETFs, which have simplified access for traditional investors.

Historical patterns suggest potential seasonal headwinds ahead, but the current trend underscores renewed confidence in Bitcoin as the flagship digital asset. The 59.3% dominance level echoes pre-2021 conditions, before altcoins began eroding Bitcoin's market share. Between 2013 and 2016, Bitcoin consistently commanded 83% to 93% of the market—a dominance now partially restored.

Arkham Uncovers $3.5B Bitcoin Heist from Chinese Mining Pool Lubian

A previously undisclosed Bitcoin theft from late 2020 has emerged as the largest crypto hack in history. Blockchain intelligence firm Arkham revealed that 127,000 BTC—worth $3.5 billion at the time—was stolen from Chinese mining pool Lubian on December 28, 2020. The breach went undetected for over four years, surpassing even the recent $1.5 billion Bybit incident.

Lubian, once a top-10 Bitcoin mining pool controlling 6% of global hash rate, abruptly shuttered in early 2021. While initial speculation pointed to regulatory crackdowns in China and Iran, Arkham's analysis suggests the collapse stemmed from catastrophic security failures in private key generation.

The silent aftermath proves most striking. Neither Lubian nor the hacker publicized the theft, with the mining pool attempting to recover through 1,500 small Bitcoin transactions. The incident exposes critical vulnerabilities in crypto infrastructure oversight—particularly among opaque mining operations.

The Great Bitcoin Mystery in Lugano: Satoshi Statue Stolen, Then Found

The cryptocurrency community was jolted by the theft of a symbolic Satoshi Nakamoto statue from Lugano's Parco Ciani during Swiss National Day weekend. Designed by Italian artist Valentina Picozzi, the faceless bronze figure—a nod to Bitcoin's anonymous origins—disappeared without trace on August 3.

Satoshigallery, the collective behind the installation, responded with a 0.1 BTC bounty ($11,000) and a defiant statement: "You can steal our symbol but you will never steal our souls." The statue's vanishing act mirrored Bitcoin's own enigmatic nature before its sudden reappearance days later.

Local enthusiasts first flagged the disappearance through social media, with pseudonymous user @Grittoshi sounding the alarm. The incident underscores how physical monuments have become cultural touchstones for decentralized communities—even as their value remains purely symbolic.

Bitcoin (BTC) Price Prediction: Bulls Defend Critical $112K Support Level

Bitcoin's price action at $114,118 reflects a pivotal moment as traders watch for either a breakout or breakdown. The 0.38% 24-hour gain masks underlying tension between bullish technical signals and lingering market uncertainty.

Key chart patterns suggest potential upside. A Gartley formation on 4-hour frames and RSI divergence hint at accumulating buyer pressure. The $112,000 support—coinciding with the 20-day EMA—now serves as a litmus test for near-term direction.

Spot ETF optimism and reduced miner sell pressure create favorable fundamentals. Should BTC hold $112K, a retest of July's $123,500 peak becomes plausible. Conversely, failure to maintain this level may trigger accelerated profit-taking.

How High Will BTC Price Go?

Sophia projects a potential rebound to $120K if BTC holds above $112K support, citing technical indicators and positive institutional developments. Below is a summary of key levels:

| Indicator | Value |

|---|---|

| Current Price | $114,379.99 |

| 20-Day MA | $117,390.97 |

| Bollinger Upper Band | $121,186.58 |